Africa Travel Insurance Guide For Safaris & Adventure Tours – AfricanMecca Safaris

Africa Travel Insurance Guide For Safaris & Adventure Tours

Published By AfricanMecca Safaris | Blog Categories: Safari Planning.

Africa Travel Insurance Overview

We at AfricanMecca Safaris have been pondering for a long time about writing a complete travel insurance guide so that our customers have a better understanding of the selection process in choosing the right travel insurance coverage for Africa. Additionally, we also want to assist and guide our travelers so that they pay the lowest priced premiums and avoid overpaying for insurance coverage they do not necessarily need.

AfricanMecca travelers starting and ending their safaris and tours from the United States, would be provided the appropriate quote so as to receive maximum coverage and value available for use during their tour with a reliable and reputable travel insurance provider and its respective underwriting team to cover for unforeseen events in case something was to happen before or during their trip in Africa.

For travelers from other parts of of the world, we recommend you speak to local insurance companies based in your home/resident countries, study/review, compare and purchase your insurance from those travel insurance companies so you can benefit for country specific government rules and regulations as well as ease of filing claims and having questions answered locally. US based travelers going on a safari in Africa and looking to request a travel insurance quote can use our Contact Us section to reach out to us.

Compound the above equation in an environment where global travel operates in a chaotic world ecosystem with corporate financial bottom lines as a sole determinant of the value of a travel company, airline blurs leading to last minute flight changes, airline route cost cutting and flight cancellations, unpredictable weather and climate change, reliance on massive computerized airline scheduling and data systems without much human presence, coups and unstable governments, terrorism, ever escalating cost of living and expensive medical care — primarily available in private care and hospitals in safari countries like Kenya, Tanzania and South Africa, tour company bankruptcies and any unforeseeable issues one can conjure up.

AfricanMecca Travel Insurance Quoting & Rates Policy

Quoting the recommended and correct travel insurance policy as an ethical business practice requires consistent solid, proven work on behalf of our holidaymakers. At all times, AfricanMecca upholds the principles of compassion, integrity and honesty to offer our customers the best pricing value for coverage that will actually deliver assistance during the time of need for travel to and in Africa at the best lowest rates available without ever employing a sales commission approach.

When recommending policies, we always look out for our customer’s best interest, and not ours nor the travel insurance provider. The quality of being protected and maximum coverage available to our travelers are infinitely more valuable than any compensation offered by the travel insurance companies to us for selling or recommending their traveler insurance. We also only work with travel insurance companies that have a proven track record of customer service and claims process.

An Ever Changing Travel Landscape Open To The Unforeseeable

Gone are the good old days, where your travel professional would literally follow your movements as you travel across and in Africa, and to be personally available to you at the whim of the moment. If international flights got delayed or canceled, the tour would be pushed back to meet the tour time and airline schedules. No more!

Globalization, upward financial mobility in the world, the advent of self-planning internet based travel tools, access to knowledge and learning and reduction in costs of airline operations has made travel to Africa more accessible and possible, which has in turn boosted mass market tourism to the continent. To handle the large daily arrivals now in countries like Kenya, Tanzania and South Africa albeit with limited rooming availability and human resources require automation of the operational business process.

Subsequently, automation has made travel less personalized where travelers are a number on a daily roster and where communication is mostly done via special notes on the system rather than an in person or particular phone call to the safari camp, lodge, hotel, guide, transportation or airline. Open this up on a grander scale and on a daily basis, one can easily begin to see the picture on how a safari tour can easily unfold and breakdown with a single hiccup in the travel operational ecosystem or sequence.

Traveling to Africa and for that matter anywhere outside of one’s home country, requires the foresight to protect not only the experiential investment of the safari i.e. trip cancellation, travel interruption, flight cancellation but also the traveler themselves when in need of primary medical care, evacuation to the hospital of choice most time in nearby countries like in the case of evacuation to South Africa from Zambia, Botswana, Zimbabwe and Namibia via a private MEDIJET or the equivalent AMREF Flying Doctors when in East Africa.

Having spent over 25 years in the Africa travel trade with hands on experience, specifically safaris and travel around Eastern and Southern Africa, the various repeated questions and scenarios vacationers have asked about and faced during travels in Africa encouraged us to write a comprehensive blog on this subject from the perspective of the discerning traveler who often face confusion on which travel insurance plans to purchase, what to look for, what is important etc. all with varying degree of coverage and costs.

What Policy Items Should A Travel Select At The Very Minimum – Important Travel Insurance Coverage Items For Travel To & While In Africa?

A. Primary Medical Coverage For Travel In Africa

Reliable and professional medical services in Africa are astronomically high because of the need for hospitals to retain or have access to specialized labor (doctors, surgeons and specialists) and equipment (purchasing, operating and maintenance). AfricanMecca Safaris recommends the maximum medical coverage amount be part of any policy. A good starting point would be $100,000 in upgraded medical expenses for any travel insurance coverage for anyone visiting or traveling in Africa. This is typically the currently maximum amount what travel insurance companies will generally offer.

We also highly recommend the Travel Insurance Medical Coverage to be PRIMARY and NEVER SECONDARY. This allows the policyholder to directly file a claim for reimbursement with all the supporting diagnosis, medical documentation, bills, receipts and invoices from the doctor or hospital without needing to first file a medical reimbursement claim with the traveler’s current health care insurance provider in their home country.

For the secondary traveler insurance coverage, the insurance health care provider in the home country will need to first formally decline to reimburse the traveler. The traveler will then need to take the rejection document along with all the supporting diagnosis and related documentation from the doctor or hospital in Africa, and file a claim with the travel insurance company. This ends being a major issue for those on secondary insurance because many travelers never receive the correct and timely documentation from their current health care insurance provider in their home country to prove the rejection.

Save yourself the worries and hassle, and purchase Primary Medical Coverage when traveling anywhere in Africa. Another hidden benefit of upgraded Primary Medical Coverage is that insurance companies will often charge a deductible amount to apply towards your secondary medical claim. Selecting an upgraded Primary Medical Coverage will most times allow for a waiver of this deductible, depending on the insurance company.

Tip 1: When filing a claim for medical treatment received in Africa with your travel insurance company, you must (and we cannot stress this enough) get a letter of diagnosis of your ailment/sickness in English as well all other related receipt bills and invoices paid. The travel insurance claims review procedures are very strict and operate with verification and review guidelines. They will require documentation in English on the official hospital and doctor letterhead, and stamped with the names of the hospital, doctors and medical staff, contacts including email, phone number and website so that they are able to verify the claim with them.

Tip 2: The amount paid for travel insurance coverage especially upgraded Primary Medical coverage when traveling to Africa for covered unforeseen events, in the grand scheme of things, is negligible compared to the peace of mind and superb value it offers. Just ask someone who lives in Africa on how unaffordable and inaccessible medical services are for those who need them regularly.

Tip 3: For extensive medical services, hospitals like those in Kenya and Tanzania like the Aga Khan Hospital in Nairobi, Mombasa and Dar es Salaam will require a large initial payment to guarantee service and compensation to them. Immediately get in touch with your insurance carrier to alert them of this issue so they can work with the hospital on a deposit payment to be paid so medical services can continue to be rendered to the allowable benefit amount.

Tip 4: Hospitals in Africa are keen to add on charges to your hospitalization so review all the charges being applied to your stay. The insurance will cover only selected items. Please review the insurance description of coverage in full so that you are aware of what will be covered as part of the hospitalization and what will need to be paid out of pocket.

Tip 5: Travel Insurance marketing material are often written with generalized emotional eye-catching clichés and examples, leading one to believe the specific one line blurbs and examples would apply to all situations. Please review the insurance description of coverage in full which will elaborate the complete conditions.

B. Evacuating To A Hospital You Prefer

The typical basic travel insurance will only cover medical evacuation, with prior approval of course. If you do not get approval before evacuating, the insurance company will typically cap amounts to the maximum they would pay if the insurance company would have utilized the services of their preferred evacuation provider with the rest to be borne by the insured traveler, from the point of incident or accident to the nearest adequate licensed medical hospital or clinic, or/and from one hospital to the next nearest one for reasons being that the medical services at the current clinic are not available, which must also be certified by the local attending medical physician.

The costs for these are normally capped to approximately $100,000. We recommend the freedom to choose the upgraded choice to evacuate to a hospital that suits the best needs of the insured traveler where services are not limited to geography when traveling in Africa. The maximum benefit for this advantageous upgrade is about 1 million on average, and supplementary costs are relatively small to add this to one’s insurance policy.

C. Taking Advantage Of The Highly Valuable Pre-existing Medical Waivers

Travel Insurance companies often provide a valuable 14-day window from when the first deposit is placed towards the trip, be it the airline ticket purchase or the land portion of the Africa safari trip itself. The complete price of the entire trip must be protected within this 14-day window to receive a waiver of the medical conditions or illness the insured had faced in the previous 6 months before the payment of the deposit PROVIDED YOU DO MEET SOME OF THESE CONDITIONS: you are still healthy for travel; are not receiving ongoing treatment when arranging for your safari in Africa; your ailments/sickness/health is getting better not worse; not taking medication because the illness is in control etc.

In simple terms, what the travel insurance medical coverage for travel in Africa wants you to be is healthy enough to travel to Africa before purchasing their policy. Travel Insurance companies are experts at managing risk; they are also in the business of protecting the unforeseeable, particularly for healthy travelers. Going into any safari or travel to Africa knowing that you are already unwell will not bode well for them, so they are not going to agree to a claim when presented with one.

We highly recommend AfricanMecca Safaris travelers take advantage of the Pre-existing Medical Waivers provided by the travel insurance company for travel to and in Africa (or anywhere else in the world for that matter) when you meet the conditions outlined by the travel insurance company. Please always review the travel insurance description of coverage in full.

D. The Best Available TRIP CANCELLATION Travel Insurance For Africa

The base standard travel insurance coverage for TRIP CANCELLATION would cover for situations like (some of the many common ones): major illness – where the insured, their immediate partner or immediate family members are unwell to the point that it would be impossible to travel (which will always require certification from a doctor); extreme weather like snowstorms, hurricanes which would cause the flights to get cancelled; unplanned or last minute airline strikes common in countries in Europe where many flights connect from the US and Canada.

AfricanMecca Safaris recommends the inclusions of other often key missed trip cancellation inclusion coverage to pay attention to, especially in the current unpredictable geo-political-climate change environment we live in, such as an officially certifiable illness or sickness at the safari camps or lodges being visited in Africa, bankruptcy of the camps, lodges, hotels, ground transportation and tour operations, chartered, low cost carrier or commercial airlines associated with your trip; a case of terrorism within a certain time period before arrival at one of the countries in Africa you will be visiting as part of your confirmed safari tour (note: coup and wars are typically not covered as reasons under trip cancellation as they are not considered terrorism. Coverage for coup and wars may be available under a separate option like item H below:

Cancel For Any Reason so select the right insurance coverage if you are traveling to a country in Africa prone to such a possibility); if yourself or your traveling partner have lost a permanent job which you had held for over 1-2 years at no fault of your own; a traffic accident occurs on route to your destination where the insured traveler was delayed or personally involved in an accident – for which a police report will be required to ascertain the event took place; a change of employment work schedules which requires the insured traveler to work during otherwise scheduled off or vacation days – which will require documentation for reimbursement.

E. The Best Available TRIP INTERRUPTION Travel Insurance For Africa

Should an unforeseeable Trip Interruption incident occur such as inclement weather, flight cancellations, strikes etc., aside from the unused portion of the trip where a claim can be submitted for reimbursement at a later point upon your return back to your home country, insured travelers will also incur additional costs to rejoin the trip based on their arrival date in Africa i.e. with new flights, ground transportation services, reorganizational and rebooking services. We recommend protecting for these additional costs to rejoin the trip mid-way under your Africa trip interruption insurance at a minimal cost.

F. The Best Available MISSED CONNECTION Travel Insurance For Africa

The base Missed Connection coverage is a very common problem for which most travel insurance coverage offers little coverage in smaller amounts with additional caveats like how long the delay has to be, which cause a missed connection before travel insurance coverage will pay. We recommend leaving between 5-6 hours of connection time when connecting between flights to allow for the insured to meet the 3-4 hours’ minimum hours of delay requirement before coverage can be applied, especially where there is no other connecting flight later that day which will then require an overnight and space available on the next flight – a challenge on its own. We highly recommend upgrading this, so you have a larger benefit available to you, greater than the base. Please review the insurance description of coverage in full for options.

G. The Best Available TRIP DELAY Travel Insurance For Africa

The base Trip Delay coverage is a common problem for which most travel insurance coverage offers little coverage in smaller amounts with additional caveats like how long the delay has to be (12-14 hours typically) on route to the final destination before travel insurance coverage will take effect. We highly recommend upgrading this, so you have a larger benefit available to you, greater than the base. Please review the insurance description of coverage in full.

H. Cancel For Any Reason Travel Insurance For Africa

The optional add on coverage Cancel For Any Reason (CFAR) benefit provides a peace of mind, flexibility and freedom to those traveling to Africa, and affords coverage for items that are typically excluded from the core base coverage i.e trip cancellation, trip interruption etc.

The protections received from Cancel For Any Reason coverage kicks in for occurrences which are NOT typically covered by the main standard policy as the Cancel For Any Reason are occurrences that are looked at as foreseen circumstances — like for example unplanned personal matters one needs to attend to 1 week before your travel date, whose reasons for cancellation are not covered under the standard/core coverage as reasons to cancel a whole trip.

A second example can be: before your travel date, awareness of a potential issue comes up in the area you are traveling to (like government election dispute, wars, riots, illness/pandemic or climate/weather pattern change) and are fearful of visiting a particular area because of a possible situation that may or may not arise, and affect you or your travel plans so you decide not to risk it and maintain your peace of mind, and willingly decide to cancel your African safari or trip. The critical take away from the second example is that the potential issues must NOT already be in place at the time of booking because your claim will not be approved for issues you already knew about when or before booking your African safari or trip.

For more details, check the coverage terms of your policy to review more on your specific coverage and exclusions. We recommend you call your insurance company with your quote or policy confirmation reference on a recorded line to discuss the specifics on all situations that you may face that you need coverage for outside of the core/main standard coverage. Reputable insurance providers will have an option to provide Cancel For Any Reason coverage that reimburses the traveler for 50% or 75% of the cost of the trip with an almost no questions asked approach when the following conditions are typically met:

1. At time of purchase of the policy, the complete costs including all non refundable items must be accounted for to include but are not limited to the international airlines, extra overnight hotels, the safari package, optional day tours, balloon safaris or extra services; all these must be covered, protected and bound – from end to end with in 7-14 days. If you do not know the cost of some of the non-refundable items or components of your trip, typically in the case of African safaris or travel – international flights come to mind, which are released 330 days before departure, a best guesstimate/over estimate is required on the possible international airline flight price based on recent historical data available.

2. You can add Cancel For Any Reason when purchasing the main policy (typically right after you make your first deposit towards the trip) or if you are thinking about whether it is worth adding it on, must be added within 7-14 days of initial/first deposit or payment date. It cannot be done after the expiry of these set date periods as indicated by the insurance company guidelines.

3. Cancel For Any Reason coverage will not provide reimbursement if you cancel your trip or safari 48 hours before departure for this specific coverage only (each travel insurance company varies so check your terms). You will be covered if your condition falls under the main standard trip and travel insurance coverage – like hospitalization from a injury, fall, sickness, etc.

4. No coverage for a country deemed high/extreme risk to travel. Check with your insurance company on the list of countries they designate as high/extreme risk. This falls under the foreseen items clause so they won’t cover for a visit to this country. Each insurance company terms vary so check your terms.

5. If your particular state regulation approved for this kind of coverage to be provided to its citizens and residents as Cancel For Any Reason is excluded in a few specific states.

An example of Cancel For Any Reason works with a 75% and 50% optional add on coverage to your policy : $10,000 safari to include non refundable flights for items not already covered under the standard main trip cancellation policy will yield an insurance claim payment to the insurance company of $7500 or $5000 at 75% or 50% coverage options respectively. Naturally, the insurance price premium on a 50% coverage add on is lower than the 75%.

Last but not least, we are often asked this question so we will address it: if there is a 100% Cancel For Any Reason benefit option. Currently, reputable travel insurance companies have reduced or eliminated the 100% Cancel For Any Reason benefit option that used to exist in prior decade(s) due to the abuse of this benefit where travelers would cancel at will and could file a claim for the complete amount. Understandably, to share some of the responsibility of the cancellations with the travelers, the insurance market place currently offers a 75% or 50% option. This might change with time.

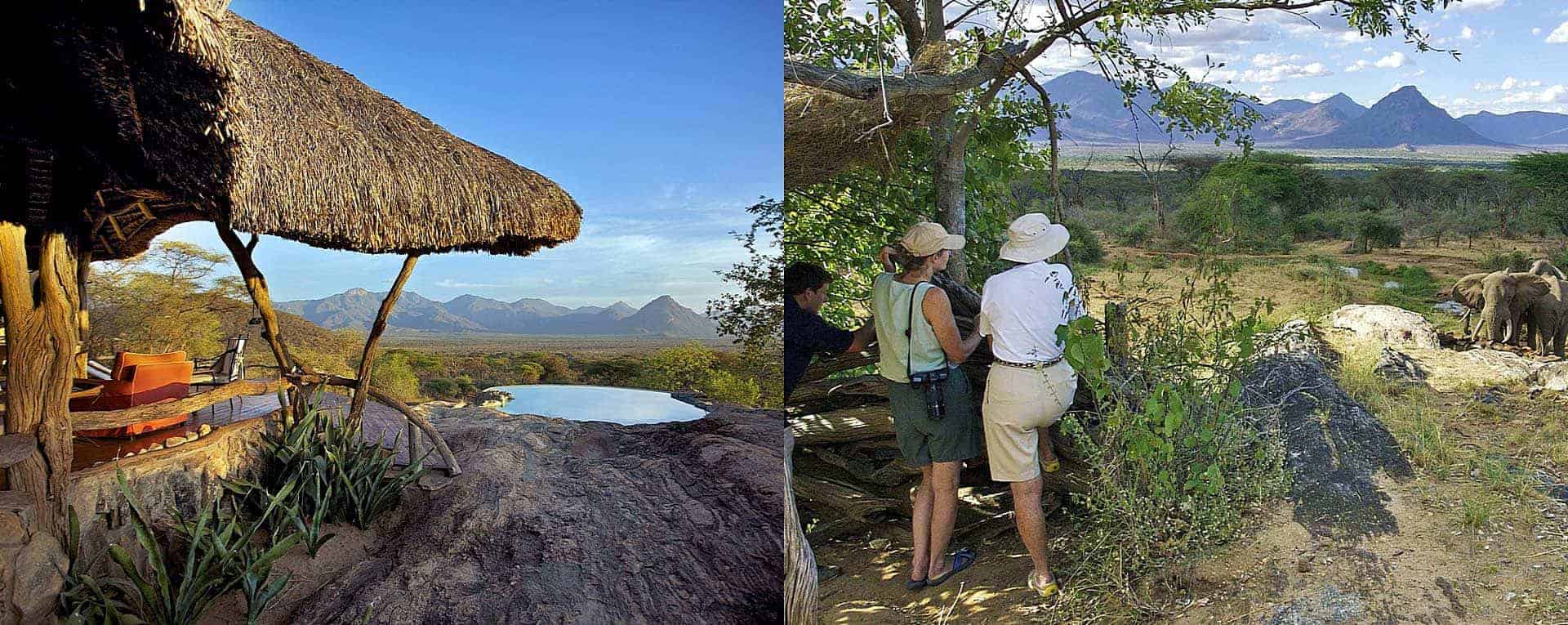

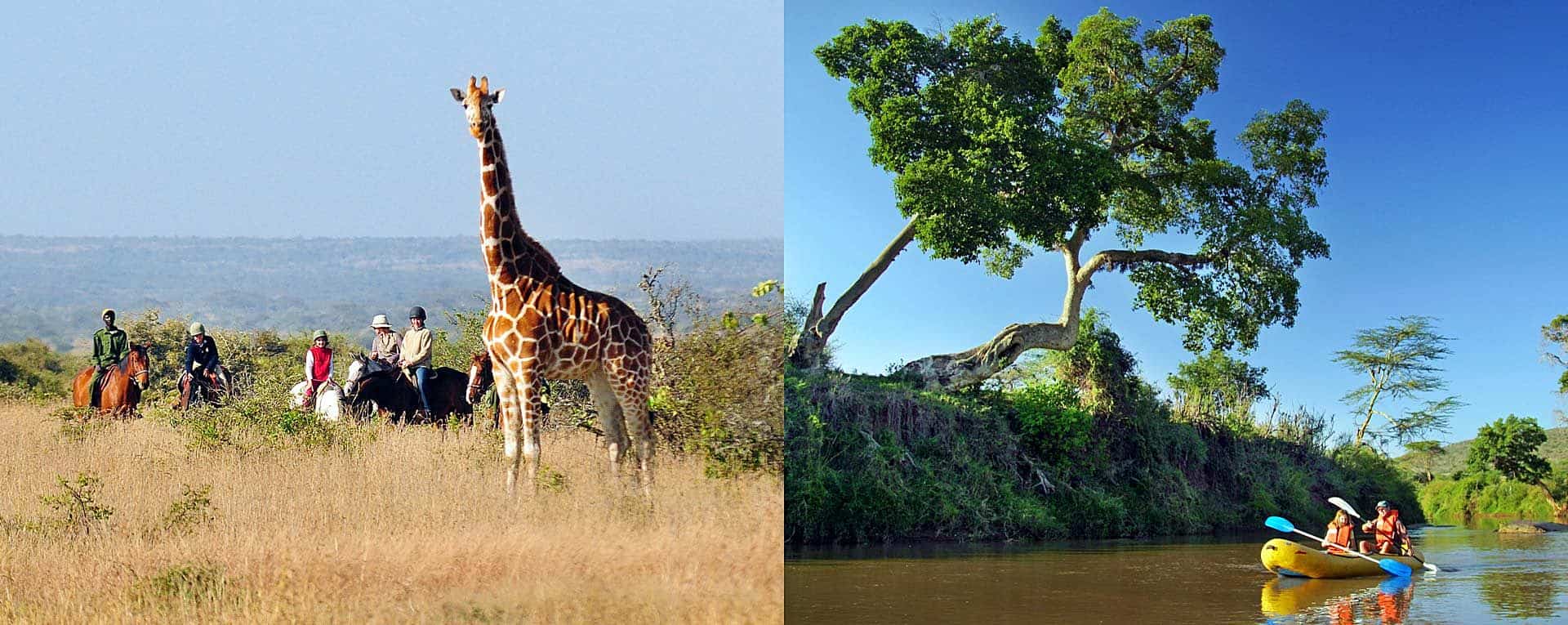

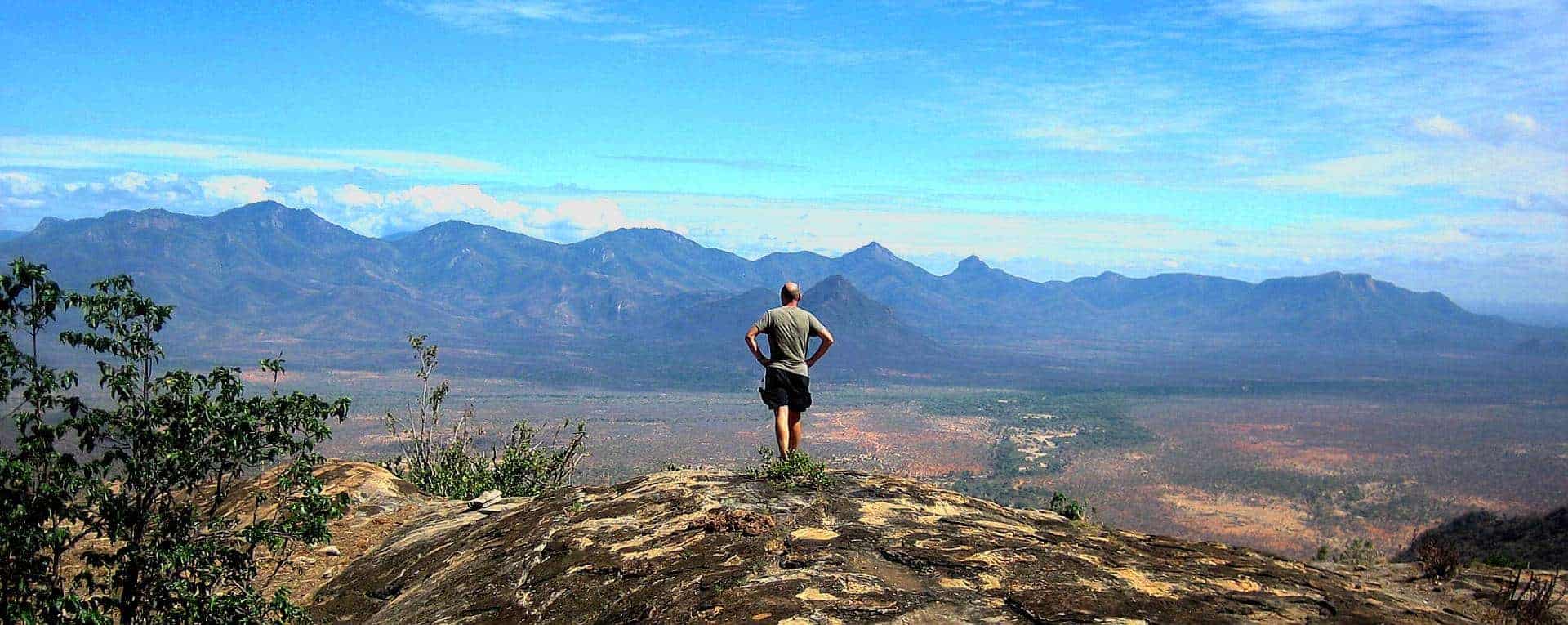

I. Adrenalin, Endurance Activity, Adventure & Sports Coverage For Africa

For any safari in Africa, where travelers seek out the enjoyment of activities outside of traditional enclosed game drives on vehicles, adventure coverage upgrade must be purchased as part of any traveler insurance coverage. Such activities include and are not limited to mountaineering (Mount Kilimanjaro treks or Mount Kenya climbs), bush and nature walks (offered at many parks and reserves in Africa), walking safaris (Zambia, Zimbabwe, Tanzania), hot air balloon safari (Masai Mara and Serengeti), river boating safaris and canoeing (Botswana, Zambia and Tanzania), Bungee jump and whitewater rafting (Victoria Falls), All Terrain Vehicles (Namibia and Botswana) and close and personal wildlife interactions (Kenya, Botswana, Zambia and South Africa). Most reliable base travel insurance coverage will most likely not cover for these adventure activities and an upgrade will be required. Please review the insurance description of coverage in full.

J. Added Baggage Items & Delay Coverage

The base Baggage Delay and Baggage Personal Items coverage is a common problem for which most travel insurance coverage will first push the responsibility on to the airline as per its official baggage delay policies. The travel insurance will provide secondary coverage for baggage items not received because of a delay, for a specific time period typically 12 hours after you have reached your inbound destination as ticketed. It does not apply for coverage on your return back to your home destination after your safari trip.

The travel insurance caps the reimbursable coverage of necessary personal items to smaller amounts and also allows for a greater upgraded protection purchase amount with an option to make the coverage primary and eliminate the out of pocket deductible. Typically all travel insurance coverage will have a deductible out of pocket amount the traveler will pay before the travel insurance coverage comes into effect.

We would recommend upgrading to primary coverage for baggage to eliminate the hassle and run around that comes with dealing with the airline carrier. Additionally, please remember if you are taking valuable items on your safari, there is only a limited amount of coverage that the base travel insurance covers, unless the additional amount upgrade is purchased, which we believe works well for travel to Africa.

Any items that are lost, damaged or stolen will require some sort of documentation to prove to the insurance company on the event occurrence like a police report or airline damage/loss report. If it is a fairly new item purchased before the trip, the compensation on the item is typically at the same rate as indicated on the product purchase invoice or receipt. We recommend keeping the receipts of purchases made for your trip. Older items are priced and compensated at the current or depreciated market value.

Contact AfricanMecca today to plan and book your dream safari

Newsletter Signup | Write A Review

Related Park & Camp Posts

Related Country & Safari Guide Posts

BLOG

VIEW ALL -- 24 December 2024 by AfricanMecca Safaris, in Blog For AfricanMecca Safaris,Safari Planning Blog Posts - AfricanMecca Safaris

What AfricanMecca Accomplished In 2024

What AfricanMecca Accomplished In 2024 Published By AfricanMecca Safaris | Blog ...READ MORE + - 26 October 2017 by AfricanMecca Safaris, in Blog For AfricanMecca Safaris,Safari Planning Blog Posts - AfricanMecca Safaris

Baggage Guidance, Flight Shuttle Service & Restrictions On Flying Safaris In Africa

Baggage Guidance, Flight Shuttle Service & Restrictions On Flying Safaris In...READ MORE + - 07 June 2017 by AfricanMecca Safaris, in Blog For AfricanMecca Safaris,Latest Kenya Blog Posts From AfricanMecca Safaris,Safari Planning Blog Posts - AfricanMecca Safaris

Masai Mara Horseback Riding Safari In Kenya With AfricanMecca

Masai Mara Horseback Riding Safari In Kenya Published By AfricanMecca Safaris | ...READ MORE +

AFRICANMECCA REVIEWS

What are our Customers saying about us? READ MORE REVIEWS![]()

Greetings to you and our most fervent thanks for a wonderful trip of Kenya, Zanzibar, South Africa & Victoria Falls. Everything went very well. This was truly a perfect vacation. Thank you so much for all your arrangements.

Adrienne & Barrie Carter - Canada

Dear Raza, The accommodations you recommended were superb. We loved them all -- Giraffe Manor, Wilderness Trails, Governor's Il Moran, Ngorongoro Crater Lodge and Mnemba Island Lodge.

Pat Bernard, Vice President, Global Channel Sales, Novell Corp - New Hampshire United States

AfricanMecca Safaris created a remarkable honeymoon tailored to our interests and desires. The quality of service and delivery of experience was unsurpassed. I highly recommend AfricanMecca Safaris to honeymooners, families, or any traveler.

Noorin & Jason Nelson - Maryland, United States

We had a great time on your safaris. Thank you very much for all that you did for us. We were in Africa overall for 5 weeks and spent time in South Africa, Zambia, Zimbabwe, Kenya and Tanzania. We just totally loved it.

Bruce and Susie Ironside - New Zealand

I cannot say enough about the quality of AfricanMecca. Their teams in Kenya and Tanzania were top notch. Raza, again thanks to you and your entire organization! We will be repeat customers.

Dan Kobick - Managing Director, PricewaterhouseCoopers - New York, United States

I booked my safari holiday through AfricanMecca. They were the most helpful company I have ever dealt with and I work within the travel industry. I had the most amazing time. The holiday went as clockwork with no hitches anywhere.

Shelley Roberts - Hemel Hempstead, United Kingdom

This is to let you know my guests, The Bryant's, had a wonderful time on the trip Samburu, Masai Mara/Kenya, Chobe/Botswana & Victoria Falls/Zambia. Everything was perfect! Thank you..

Christine Milan - MT Carmel Travel - Connecticut, United States

CONTACT AND TALK TO OUR SAFARI EXPERTS TODAY TO KICK-START YOUR TOUR PLANNING PROCESS

Request Africa Custom Or Tailor-Made Safari Pricing Based On Your Specific Travel Dates At Your Preferred Safari Tier Camp Or Lodge

CONTACT AN EXPERT ON AFRICA SAFARI PRICES & TOURSRead More +

SAFARI TRIP IDEAS FOR AFRICA

Review diverse Africa safari experiences available from luxury, honeymoons, photo and family tours to bush walks, birding, balloon trips, horse rides including private, custom and boutique options.

Read More +

BEACH TRIP IDEAS FOR AFRICA

Review diverse Africa seaside experiences available from idyllic beaches and castaway barefoot islands to scuba diving and snorkeling in marine reserves, fishing, dhow cruises and coastal excursions.

Read More +

AFRICA MOUNTAIN TRIP IDEAS

Review mountain climbing experiences available in Africa – the highest in Africa, Kilimanjaro. Go on guided treks to Mount Kenya, Meru to Ol Doinyo Lengai. Your climb is entirely your own to design.

Read More +

SAFARI PRICES FOR AFRICA

Review recommended itineraries and prices of our discerning Africa safaris with the option of customizing your tour based on your needs and preferences.

Read More +

AFRICA TRIP IDEAS

Review experiences from wildlife photo safari, horse riding, bush walks, mountain treks, honeymoon to family beach vacation, diving, snorkeling & fishing.

Read More +

PARKS & RESERVES IN AFRICA

Review information on wildlife parks and reserves in Eastern and Southern Africa: Tanzania, South Africa, Kenya, Botswana, Zambia and other countries.

Read More +

ACCOMMODATIONS IN AFRICA

Review information on safari camps, lodges, city hotels, beach resorts in Africa's pristine wilderness, cities, Swahili coastal shores and idyllic islands.

Read More +

BEST TIME TO VISIT AFRICA

Review details on the best time to go to Africa to visit its diverse wildlife wildernesses, lakes, rivers, mountains, forests, islands, beaches and other ecologies.

Read More +

BEACHES & ISLANDS OF AFRICA

Review Africa's beautiful Indian Ocean coast and islands where the turquoise waters tenderly wash up white sand beaches that create a serene ambience.

Read More +

AFRICAN COUNTRY PROFILES

Review information and travel tips on African countries: climate, culture, geography, history, tipping guide, entry requirements, what to pack and wear and more.

Read More +

CITY DAY TOURS FOR AFRICA

Review full or half day city tour options for Cape Town, Nairobi, Johannesburg, Zanzibar etc. Experiences can be customized around your vacation travels.

Read More +

TOP 12 REASONS TO VISIT AFRICA

There are infinite reasons to visit Africa e.g wildlife safaris, gorilla and chimp treks, birding, beaches, mountain climbing, cultural tours and more.

SAFARI BOOKING & TOUR HOLIDAY IDEA FOR AFRICA

When visiting Africa, we recommend your tour to varied national parks in Africa like Serengeti and Ngorongoro Crater in Tanzania, Kruger in South Africa, Chobe and Okavango Delta in Botswana, Masai Mara in Kenya to climbing Kilimanjaro, or gorilla and chimpanzee primate safari treks in Rwanda & Uganda ending with beachfront retreat to Zanzibar Island or Cape Town.

READ MORETRAVEL PLANNING GUIDE FOR AFRICA

Kickstart Your Safari Planning

ARE YOU PLANNING TO BOOK AN AFRICAN SAFARI?

Do You Need Knowledgeable, Experienced & Specialist Guidance For Your Travels In Africa? Let Us Help Plan Your Trip Itinerary Correctly

CONTACT AN AFRICA VACATION EXPERTEXPLORE MORE ON NATIONAL PARKS, CAMPS, LODGES, BEACHES & RESORTS IN AFRICA

HAVE YOU VISITED AFRICA FOR A SAFARI, BEACH OR ANY OTHER TOUR VACATION?

Write A Travel Or Tourist Trip Review To Share Your Experiences

WRITE AFRICA TRIP REVIEW